- Home

- News and analysis

- Articles

- NAGAX Weekly Recap | 29 August – 2 September

NAGAX Weekly Recap | 29 August – 2 September

We witnessed an interesting crypto summer that ended days earlier ☀️

A no less momentous fall is ahead of us – with the updated Ethereum consensus, BTC's fight for the $20K level, and much more 🤔

Let's dive into the most important crypto news that has followed us over the past week. Perhaps it will point us in the right direction in the coming days ⚡

Follow our news digest ⬇️

Bitcoin is still consolidating near the $20,000 zone against the US Dollar

Bitcoin is currently trading just below the $19,800 mark and has been going sideways for the past several days. The price is facing strong resistance around the $20,600 mark and is struggling to gain momentum on the lower time frames as well. On the other hand, the macro trend is still bearish, and we are expecting Bitcoin to touch lower levels in the coming weeks. After some sideways movement on lower time frames, we can expect the price to drop below the $19K region in the coming days.

It is also likely that Bitcoin will create new lows on the bigger timeframes in the coming weeks. We will consider it an opportunity and be interested in accumulating more Bitcoin at these lower levels.

The total crypto market cap continues to crumble as the dollar index hits a 20-year high

The total crypto market capitalization dropped by 6.9% in one week, while derivatives metrics reflect increasing demand for bearish bets.

From a bearish perspective, there's a fair probability that the crypto market entered a descending channel (or wedge) on Aug. 15 after it failed to break above the $1.2 trillion total market capitalization resistance.

Investors sought shelter in the dollar and U.S. Treasuries after Federal Reserve Chair Jerome Powell reiterated the bank's commitment to contain inflation by tightening the economy.

Accordingly, this may continue until the dollar stops rising under the influence of monetary policy. In the meantime, traders can benefit even as cryptocurrency prices fall thanks to NAGAX's variety of trading tools.

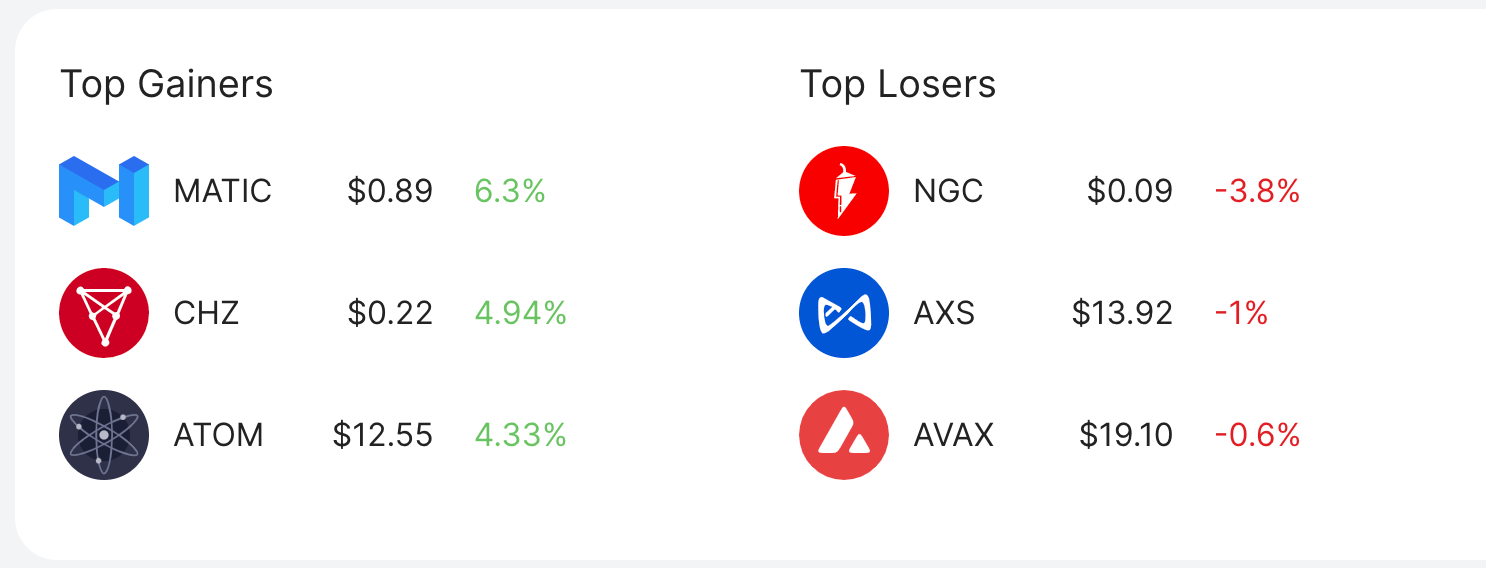

AVAX price rebounds 15% after Crypto Leaks sell-off

Ava Labs CEO Emin Gün Sirer has dismissed sensational allegations from CryptoLeaks that his company used litigation to “harm” competitors and fool regulators, labelling it as “conspiracy theory nonsense.”

A CryptoLeaks blog post alleged that Ava Labs had a “secret pact” with a U.S. law firm to sue competitors in exchange for AVAX tokens and equity.

After the charges were rejected, the value of the coin began to rise. AVAX price rebounds 15% after Crypto Leaks sell-off, but Avalanche could still bury bulls

AVAX's price established an intraday high of $19.75 on Aug. 30, two days after bottoming out locally at $17.50, amounting to a 15% rise.

Thanks for reading! Have a great weekend — more news next week! 😉

Important Notice: Any news, opinions, research, analyses, prices, or other information contained on this feed are provided as general market commentary and do not constitute investment advice or solicitation for a transaction in any financial instrument or unsolicited financial promotions. All material published on the website is intended for informational purposes only. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and therefore, it is not subject to any prohibition on dealing ahead of dissemination. We do not make any warranties about the completeness, reliability, and accuracy of this market commentary. Past performance is not an indication of possible future performance. Any action you take upon the information on this feed is strictly at your own risk, and we will not be liable for any losses and damages in connection with the use of this feed.

Risk Warning: Cryptocurrencies are highly volatile and trading can result in the loss of your invested funds. Before investing you should be aware that cryptocurrencies may not be suitable for all investors. You should therefore carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition and not invest money that you can not afford to lose.