- Home

- News and analysis

- Articles

- Crypto Rising Steadily - Bull-ish or Bull-trap? | Daily News 21/6/22

Crypto Rising Steadily - Bull-ish or Bull-trap? | Daily News 21/6/22

The cryptocurrency world 🌐 is showing a good healthy pulse at the moment, being in the green 🟢 across the board! Bitcoin is leading this resurrection by keeping its head above water (the psychological $20k level) after dipping under previous cycles’ all-time highs of $17,600 last Saturday.

Although there is still some division between those who believe we have found the bottom and those that think we still may go a little lower, we can at least have some more confidence and positivity in the hands of the bulls 🐂. Is the bear market over? Potentially, not yet, but the worst could just be in. Let's look into it further.

Bitcoin is currently priced at just over 🟢 $21,100 as of writing, showing a nice and steady recovery from its lows just a few days ago. As you can see from the hourly chart below ⬇️, we are steering away from that $20k support and breaking a light resistance level. To maintain this bullishness, we need to see buying pressure keep at it, to maintain over that $21k level and above the 20-week moving average (blue line) that we are above right now.

If we are to see further downside and see a break of the $20k level again, then a break and close of the $17,600 level could start the next level of a downtrend 📉. Many traders are looking at these levels very closely and are ready to make trades based on these simple technicals alone. If you want to learn more about the markets and how to use NAGAX, why not look at our NAGAX Academy.

The BTC 1hr chart, climbing higher into relief levels.

The BTC 1hr chart, climbing higher into relief levels.

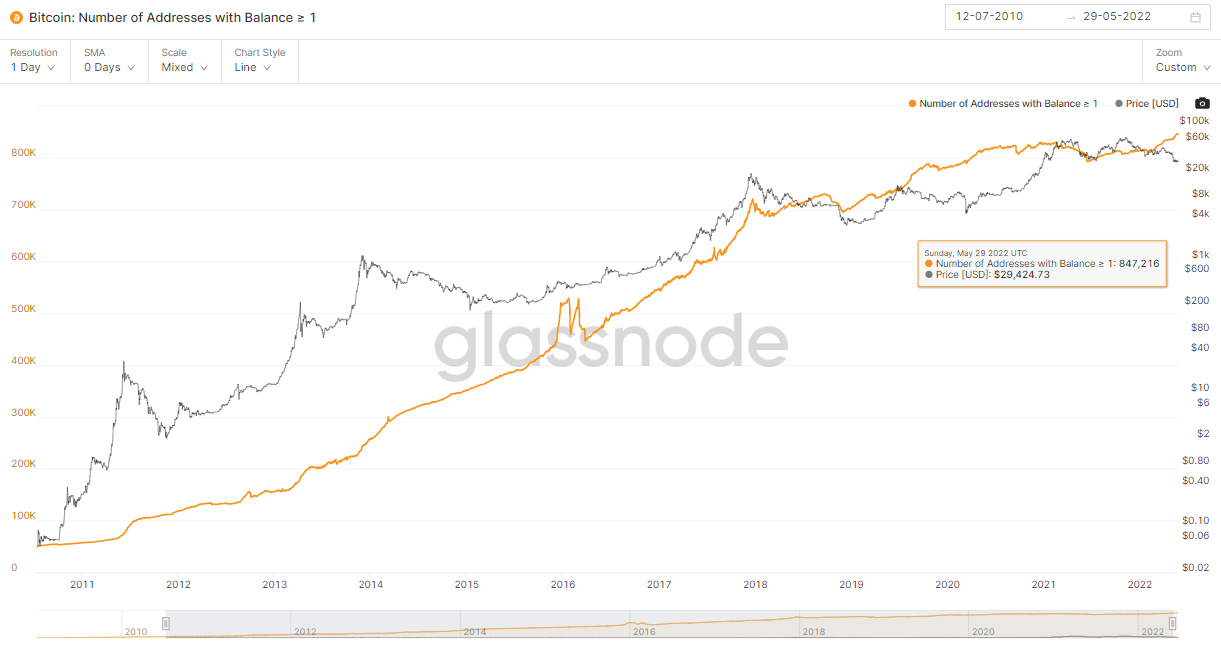

With the basic technicals out of the way, what else has been driving BTC up? Well, a very important metric 📑 that has caught our attention is the number of addresses holding at least one Bitcoin is at all-time highs according to data from Glassnode! Similarly, the number of addresses holding at least 0.1 Bitcoin has also witnessed a sharp rise. This is of big importance as it shows many people, especially recently, have decided to add and accumulate 🛒 even more Bitcoin acknowledging these have been great prices to buy at!

The number of addresses holding at least 1 Bitcoin is at an ATH!

The number of addresses holding at least 1 Bitcoin is at an ATH!

Finally, we need to look at the bigger picture 🖼️ when it comes to Bitcoin. Have we hit the complete bottom for its price? Maybe not, but as the old saying goes, “when in doubt, zoom out”. Even if you were to dollar cost average (DCA) here and add to your portfolio, or if you are buying for the first time; try not to worry about catching the complete bottom! Chances are you won’t. But from a macro perspective, these are certainly great opportunities!*

*This is not financial advice, so please do your own research and be responsible when investing.

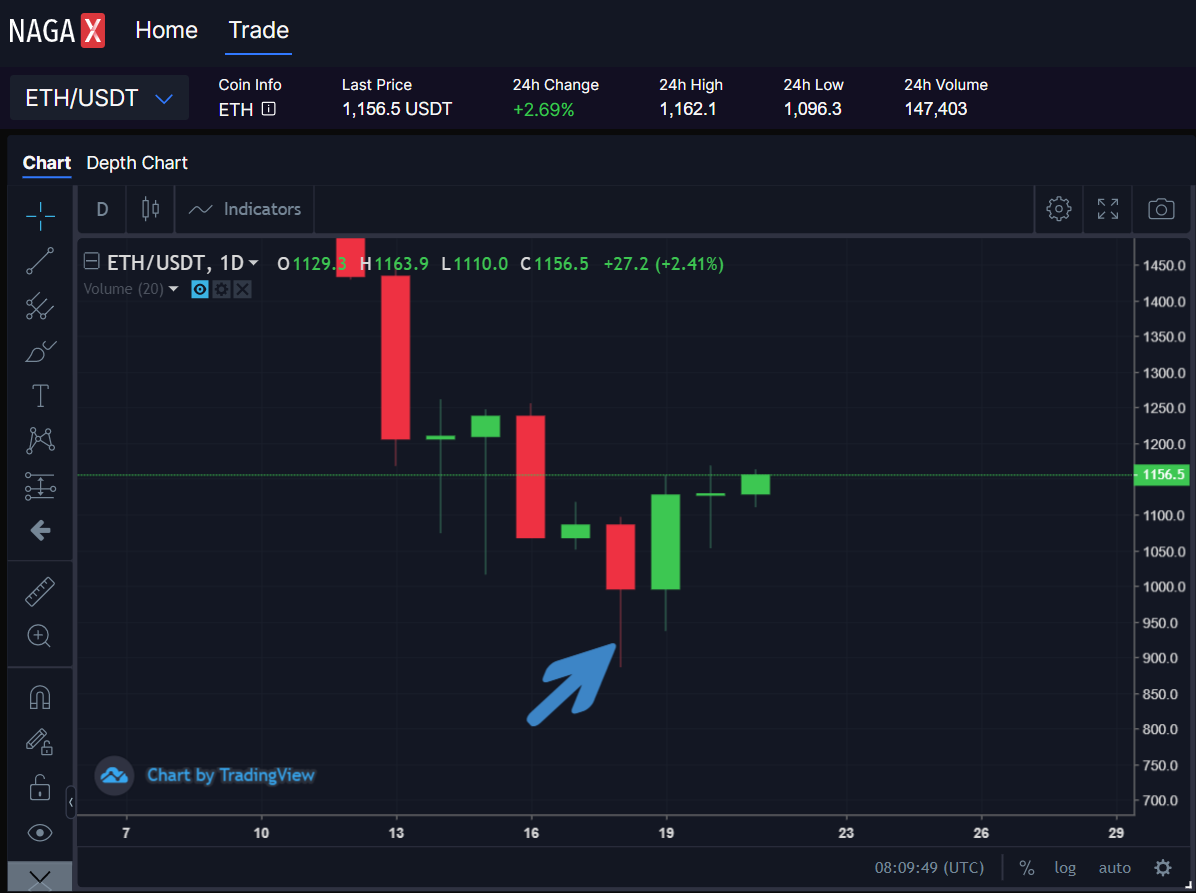

ETH is also climbing back up 🟢 from dipping below another psychological level of $1000 as we explained yesterday. A good positive to look for with Ether is that on the day the bears pulled that price down, the bulls really went shopping, buying up the dip as can be seen with the fairly long wick of that day’s candle.

Strong buying pressure from the bulls on the day ETH dipped below $1000, its psychological support level.

Strong buying pressure from the bulls on the day ETH dipped below $1000, its psychological support level.

The price increase and buying pressure could also be down to the news from Nethermind’s tweet, mentioning that Ethereum’s second public chain-merge is just around the corner.

🟢 As for other altcoins, everything is following suit with the top performers being Polygon (MATIC), Chainlink (LINK), and ApeCoin (APE) - all averaging about a 15% increase 📈 in the last 24 hours. This time in the market has clearly shown that many are adding to their bags and although we believe it is certainly a good time to do so (or at least dollar-cost averaging in); be mindful as to which altcoins you choose! The bear markets are synonymous with wittering out the corn from the weeds. Meaning a lot of the weak projects may not be around in the next upcoming bull cycle.

*This is not financial advice, so please do your own research and be responsible when investing.

🌎 A global macroeconomic perspective is also certainly vital to look at in these times of crazy interest rates, dreaded inflation and geopolitical wars!

🗠 Stock futures rose early this morning following a brutal week last week as investors calculated the situation of the Federal Reserve's aggressive strategy and the rising chance of inflation. Investors and traders will continue to monitor data including the existing home sales report (released later today) to gauge the health of the US economy. This is something that many Forex traders are going to be looking at assessing the global economic situation and of course, the aftereffects will certainly hit and affect the crypto market!

💵 The DXY (Dollar Currency Index), which is used to assess the strength of the US dollar, is continuing to show more weakness for the currency. If this continues in conjunction with the equities markets carrying on with their upward momentum; this will certainly be the lift that Bitcoin, and the whole cryptocurrency space, needs!

Summary:

Bitcoin is currently up over 20% since its recent lows, showing strength in its rebound Ethereum and the rest of the alt market is up following Bitcoin’s move Great on-chain data showing accumulation of crypto by addresses are great stats to look at in times like these Equities futures markets are up and US dollar weakening, good news for crypto!

Important Notice: Any news, opinions, research, analyses, prices, or other information contained on this feed are provided as general market commentary and do not constitute investment advice or solicitation for a transaction in any financial instrument or unsolicited financial promotions. All material published on the website is intended for informational purposes only. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and therefore, it is not subject to any prohibition on dealing ahead of dissemination. We do not make any warranties about the completeness, reliability, and accuracy of this market commentary. Past performance is not an indication of possible future performance. Any action you take upon the information on this feed is strictly at your own risk, and we will not be liable for any losses and damages in connection with the use of this feed.

Risk Warning: Cryptocurrencies are highly volatile and trading can result in the loss of your invested funds. Before investing you should be aware that cryptocurrencies may not be suitable for all investors. You should therefore carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition and not invest money that you can not afford to lose.