- Home

- News and analysis

- Articles

- Crypto - More Bullish Than Bearish And Here’s Why | Daily News 23/6/22

Crypto - More Bullish Than Bearish And Here’s Why | Daily News 23/6/22

The market has settled once again 🪀 as Bitcoin ended its 3-day run-up over $20k, as it dipped below that psychological support level yesterday before regaining above again later in the afternoon.

Ether however, didn't dip below its threshold of $1000 but did fall in price overall as well as the other altcoins. But as of writing, today has started with a positive green momentum so let's dive in 🤿 to see what we can make of the market today!

Bitcoin yesterday fell about 5% yesterday dipping below the ‘infamous’ $20,000 level that everyone has their keen eye 👁️ on! This decline in price 📉 came in just a couple of days after bitcoin broke through the $21k levels. The price yesterday did bounce back over that key support level, but with the day closing in 🔴 red. Today however, it looks like BTC has woken up with a spring in its step so far (although it is still morning as of writing) where buying pressure has stepped up with more people presumably accumulating more bitcoins at this price! 📈

As we can see in the chart below 👁️⬇️, we can see where Bitcoin started its positive recovery with its long wick on 21st June’s candlestick (see blue arrow), but suggesting that the bears are not willing to surrender their advantages.

The Bitcoin chart on a daily time frame; shows support and resistance levels and the fight between bull and bear.

The Bitcoin chart on a daily time frame; shows support and resistance levels and the fight between bull and bear.

A positive that we can take in is that the bulls are certainly buying the dips at around the $20k region. If the price keeps its upward 🔼 momentum, the bulls will try to drive the price above $22,000. This could open the doors for a possible rally to the 20-day moving average (pictured as the white line). This level however will act as a strong resistance. Of course, the flip side of the coin is if we do switch and break down below the $20k level again, then we have a stronger possibility of retracing back to our low of $17,600.

Let's take a look at the NUPL Bitcoin indicator, which is showing bullishness 🐂 also. The Net Unrealised Profit & Loss is indicating that selling pressure is decreasing 👍 as less people are willing to sell their Bitcoin at these prices; thus indicating it's a great time to buy! Historically it hasn't been wrong so far as you can see where we have marked below. Some are arguing that we are at a ‘sign of the times’ where things are very different in the economy.

The NUPL Bitcoin Indicator by Glassnode shows bullishness!

The NUPL Bitcoin Indicator by Glassnode shows bullishness!

This week will certainly be crucial to the prices as eyes are on not only the $20k support level of Bitcoin, but on the 🌐 global macroeconomic space as a whole. Let's see where we go from here!

👉 In the meantime, if you are just holding onto your Bitcoin and not interested in these price fluctuations for the short term, then why just sit on them?! 💡 Go to our NAGAX Earn and stake your BTC (and others) and let your crypto work for you!

Starting with crypto’s biggest altcoin by market cap, Ethereum is down in the last 24 hours but actually managed to hold itself 💪 over the crucial $1000 support level unlike Bitcoin! Ether is leading the altcoins in the red 🔴, being approximately priced at about $1100 and is down about 1.59% in the last 24 hours. And for the most part, following BTC almost identically.

Out of all the top 100 coins (according to coinmarketcap), Synthetix (SNX) has performed the worst in the last 24 hours by being down by about 10% whereas all the rest are slightly up in the green and just a few in the red. The main reason for this is mainly just because only a few days ago, SNX doubled in price so a drop 📉 of this amount is expected. 🟢 As for top performers though, nothing is close to how Polygon (MATIC) has reacted in the market, increasing in price by over 26% in just the last 24 hours! This is based on the recent news of the MATIC network claiming that it has achieved carbon neutrality, a balance between emitting and absorbing carbon. And we all know how there's a lot of buzz about being environmentally friendly 🍃 in crypto!

🏛️ Investors once again have shied away 🙈 from investing in riskier assets whilst they digested the latest testimony by the Fed Chair Jerome Powell yesterday. The main point that he projected to the Senate is that the U.S. might not be able to avoid a recession. All the while, critics of the Fed have been very vocal about how the bank waited too long to boost interest rates, forcing it to adapt to applying the harsh measures that have been put in place. This is partly due to why the crypto markets have been bearish, and why $20k seems to be the anchor ⚓ point right now!

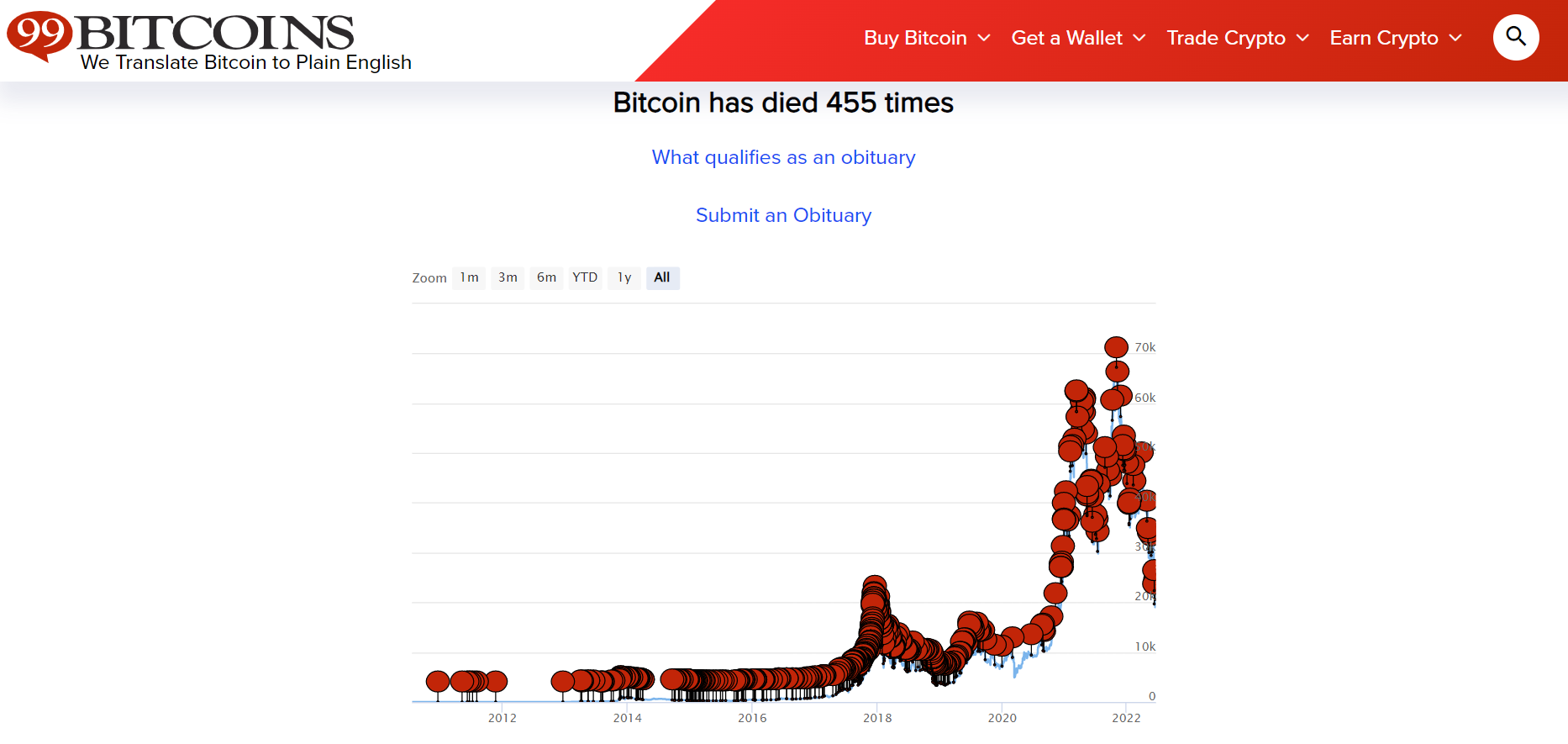

Once again, there has been word from official Chinese national media outlets warning Bitcoin could go to ‘zero’ (which by the way, has become a tiresome habit 🔁 from them) to dissuade their readers to invest and use crypto! Let this image below from ‘99Bitcoins’ answer that!

☍ In contrast to the China FUD, the Bank of England 🏛️ has begun to be bullish in building wealth in the crypto space in the market. Dep Governor Jon Cunliffe expressed faith in crypto saying that the technology will outlive the current volatility just as the internet economy overcame the dot-com crash! 🏋️♂️

🇬🇧 Keeping to the UK theme, Tether (the issuer of the largest stablecoin by market cap, USDT) is planning to launch a new stablecoin that will be pegged to the British Pound (GBP) next month and it will be named ‘GBPT’. This 📰 announcement has come at a good time as the U.K. is positioning itself as a hub for crypto while their government is moving forward with regulations in crypto, recognising stablecoins as a form of payment. We are still yet to know how the GBPT will be backed, but it's likely it will be fiat-backed similar to Tether’s other stablecoins.

Summary:

- Bitcoin back towards $20k!

- Bitcoin has ‘died’ 455 times since its inception; invalidates ‘Bitcoin to zero’ statements.

- Polygon has gone up by 26% in the last 24 hours due to carbon neutrality news.

- Tether has announced ‘GBPT’ - a stablecoin pegged to the British Pound.

Important Notice: Any news, opinions, research, analyses, prices, or other information contained on this feed are provided as general market commentary and do not constitute investment advice or solicitation for a transaction in any financial instrument or unsolicited financial promotions. All material published on the website is intended for informational purposes only. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and therefore, it is not subject to any prohibition on dealing ahead of dissemination. We do not make any warranties about the completeness, reliability, and accuracy of this market commentary. Past performance is not an indication of possible future performance. Any action you take upon the information on this feed is strictly at your own risk, and we will not be liable for any losses and damages in connection with the use of this feed.

Risk Warning: Cryptocurrencies are highly volatile and trading can result in the loss of your invested funds. Before investing you should be aware that cryptocurrencies may not be suitable for all investors. You should therefore carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition and not invest money that you can not afford to lose.