- Home

- News and analysis

- Articles

- Crypto & Stocks Taking A Dip | Daily News 28/6/22

Crypto & Stocks Taking A Dip | Daily News 28/6/22

📉 We have seen the crypto market dip in the last 24 hours but Bitcoin is still holding on strong 💪 above $20,950, being down just over 1%; still far enough from the $20k support it crossed just over a week ago! The second largest crypto Ether, also dipped slightly by almost 2% in the last 24 hours and is currently trading at just under $1220; a price it hasn't really deviated much from in a week proving traders are taking a more cautious approach to riskier assets with light trading. Finally, alt coins have been pretty stable over the last day or so, most slightly in the 🔻 red.

As for the 🌎 global markets, the Nasdaq and the S&P 500 dipped 🔻 yesterday both at around a percentage point after the S&P especially closed the week last week with its biggest single-day gain in two years 😲📈. This could go on to prove that consumers are slightly more optimistic about the future rate of inflation and showing small signs of economic cooling. However, bearish sentiment amongst investors has actually increased to 58.3% according to the AAII short-term investor optimism survey that market research firm Macro Hive has cited.

Bitcoin took a pretty big dip 🔻 midday yesterday being down almost 2% in the last 24 hours. BTC tested momentarily $20,500 a few times where it is now sitting in a range between there and $20,950. There is pretty strong resistance at $20,900 indicated in the chart below by the horizontal yellow-ray line that Bitcoin needs to break through to keep with its ➕ positive momentum it has carried since last week. But as of now, it is sticking to this channel between the red support line of $20,500 and $21,000.

The BTC/USDT 1 hour chart showing the price in the channel of $20,500-$21,000

The BTC/USDT 1 hour chart showing the price in the channel of $20,500-$21,000

But if Bitcoin loses its bullish momentum 📉 and drops below the $20,500 support line above, then we could potentially see the price getting back to that big psychological support level of $20,000 🔴 by the end of the week. The bears will then have to prove their strength to see if they can bring the price back to the previous lows of $17,600.

Many traders and investors are remaining bullish 🐂 due to the fact that the Relative Strength Index (RSI) has dipped below 30 for the third time in Bitcoin’s history showing BTC is very oversold; with the last two times occurring near the market bottom. However, the main question is, how long can Bitcoin stay at these levels if indeed, we have seen the bottom 🍑 of this bear market? Well historically, we have seen BTC trade in a choppy sideways range for up to several months before making strong recoveries. It’s good to remember something we always say: History isn't always indicative of future performance, but it often rhymes!

The history of Bitcoin’s RSI hitting lows in reflection of bear market bottoms

The history of Bitcoin’s RSI hitting lows in reflection of bear market bottoms

To round up, the weakness in the crypto market has been apparent since the start of this year, but the real driving force behind the market crumbling 🔻 includes talks of inflation and rising interest rates! These rising interest rates 🧮 tend to be followed by market corrections, and given that the Fed intends to keep to the hikes, Bitcoin and other similar risk assets could look to correct even further.

Ethereum is currently holding up 📈 pretty well despite market drops in the last 24 hours. Ether is currently priced at just over $1220 and is sitting above that 100-day moving average even though it is still on a downtrend. There is immediate resistance on the upside at around $1225 which it is very close to at the moment. If ETH can break this level, then we can see a further rise 🔺 to the upside as buying pressure increases.

The ETH/USD chart on the 1hr timeframe holding strong

The ETH/USD chart on the 1hr timeframe holding strong

However, if Bitcoin is to continue with further movement to the downside, then ETH will be sure to follow!

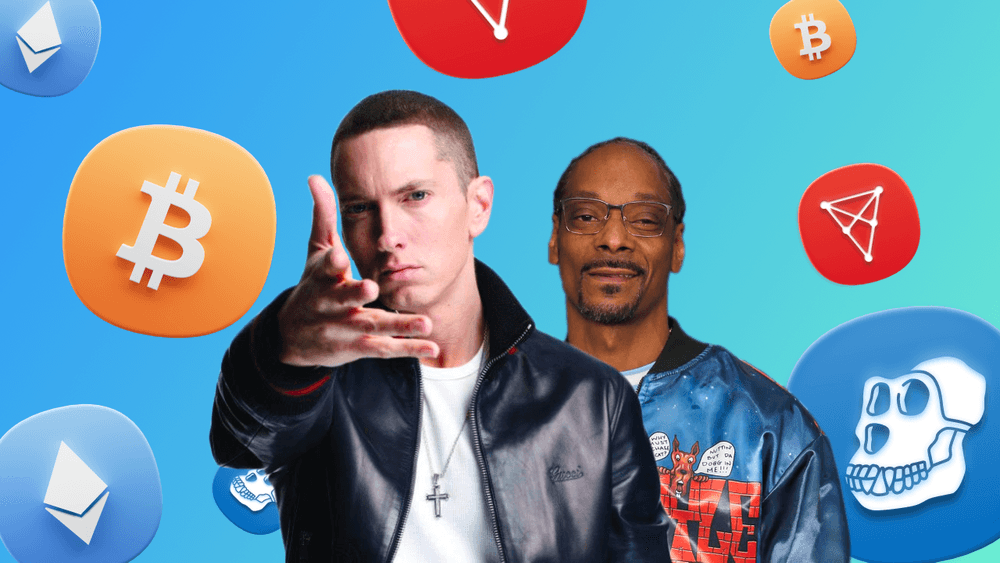

👀 Looking at the altcoins market, the majority have stabilised and some are dipping heavier in the red. Chiliz (CHZ) is currently up 🟢 about 10% in the last 24 hours, wiping out the previous day’s losses and continuing an aggressive trend that has lasted for more than a week. And ApeCoin (APE) is also up 🟢 just over 6% as of writing since two legendary rappers, Eminem and Snoop Dogg recently collaborated on a new song 🎵 “From The D 2 The LBC” and performed it at the ApeFest for Bored Ape Yacht Club (BAYC) holders. Since the performance, ApeCoin has seen a 30% hike in less than a week. Can it continue its bullish trend ⁉️ Or is it topping out?

🔴 The main two biggest losers right now in the market are Uniswap (UNI) and Polygon (MATIC) both down 📉 about 7% respectively in the last 24 hours. This was to be expected as MATIC especially, was one of the biggest gainers last week!

💹 Large-scale stock indexes dropped slightly with the tech-heavy Nasdaq and S&P 500 both down about 1%. The latter closed Friday with its biggest single-day gain 💪 in two years amid a confident sentiment being more upbeat about the future rate of inflation and showing small signs of economic cooling that might have the U.S. central bank to scale back its monetary hawkishness 🦅 later in the year.

US Census Durable Goods & Home Sales Report Recap

📖 The U.S. Census Bureau durable-goods report was released yesterday showing orders climbed higher than expected in May. We also saw a rise in the pending home sales report for the month, according to the National Association of Realtors countering this trend. This accounted for a small rise ⤴️ in the US Dollar Index, which is why the equities markets felt a bit 🔻 of a decline. This of course in turn has that domino effect we keep mentioning, leading to Bitcoin dropping also!

👉 Don't forget to have a look 🕵️♂️ at this weeks upcoming events that we list for you every Monday; keeping you up to date with what is happening, what events to look out for, and how they will affect the global markets!

Summary:

- Bitcoin and the rest of the crypto market dipped yesterday after a pretty good run over the last week.

- The equities markets also dipped showing the correlation between Bitcoin and Tech Stocks.

- Chiliz and ApeCoin both lead the alts in the green, but the majority are in the red.

- The Durable Goods and Home Sales Report was released yesterday creating some volatility in the markets which led to the markets dipping while the US Dollar Index showed some growth.

Important Notice: Any news, opinions, research, analyses, prices, or other information contained on this feed are provided as general market commentary and do not constitute investment advice or solicitation for a transaction in any financial instrument or unsolicited financial promotions. All material published on the website is intended for informational purposes only. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and therefore, it is not subject to any prohibition on dealing ahead of dissemination. We do not make any warranties about the completeness, reliability, and accuracy of this market commentary. Past performance is not an indication of possible future performance. Any action you take upon the information on this feed is strictly at your own risk, and we will not be liable for any losses and damages in connection with the use of this feed.

Risk Warning: Cryptocurrencies are highly volatile and trading can result in the loss of your invested funds. Before investing you should be aware that cryptocurrencies may not be suitable for all investors. You should therefore carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition and not invest money that you can not afford to lose.